Ready to use legal template

Work on without any hassle

Compliant with Filipino law

Ready to use legal template

Work on without any hassle

Compliant with Filipino law

Home › Accounting › Invoice

Learn more about Invoice in Philippines

An invoice is a formal document issued by a seller to a buyer, detailing the products or services provided, their costs, and the payment terms. It serves as a critical financial record, ensuring transparency in business transactions and facilitating proper bookkeeping. In the Philippines, invoices play a key role in tax compliance, as they support Value-Added Tax (VAT) reporting and business accounting requirements under the Bureau of Internal Revenue (BIR). Proper invoicing helps businesses maintain accurate financial records, fulfill tax obligations, and avoid legal issues. Whether you operate a small business or a large corporation, having a well-structured invoice is essential for managing payments efficiently and ensuring smooth financial operations. Download our Invoice Form, easy to edit in Word format, expertly drafted for use in the Philippines.

Table of contents

What is an Invoice?

What is the importance of invoicing for small businesses in the Philippines?

How to write an effective Invoice in the Philippines?

What are the regulations regarding tax Invoices in the Philippines?

How to Invoice as a freelancers in the Philippines?

What is the common Invoice mistakes to avoid in the Philippines?

How to send Invoices to customers?

What is an Invoice?

An Invoice in the Philippines is a document that serves as evidence of a transaction between a seller and a buyer. It contains information such as the name and address of the seller and buyer, a description of the goods or services provided, the price, payment terms, and other relevant details. In the Philippines, an Invoice is an important legal document for both the seller and buyer as it serves as proof of the transaction and is used for tax purposes. It is required by the Bureau of Internal Revenue (BIR) to issue Invoices with specific details such as the taxpayer identification number (TIN) of both parties, the Invoice number, date of transaction, and other relevant information. Invoicing is an essential part of doing business in the Philippines, and it is important to follow proper invoicing practices to ensure accurate record-keeping and timely payment.

What is the importance of invoicing for small businesses in the Philippines?

Step 1. Legal Requirement

Invoicing is a legal requirement in the Philippines. The Bureau of Internal Revenue (BIR) mandates that every business must issue Invoices for every transaction. Failure to comply with this requirement may result in penalties or fines.

Step 2. Record-Keeping

Invoicing provides a record of every business transaction, which is crucial for accounting and tax purposes. It enables businesses to track their income and expenses, prepare financial statements, and file tax returns accurately.

Step 3. Payment Collection

Invoicing makes it easier for small businesses to collect payments from customers. A well-designed Invoice clearly outlines the payment terms, including the due date and payment methods, which can help prevent payment delays.

Step 4. Professionalism

Professional-looking Invoices can enhance the credibility of small businesses and make them appear more professional. A clear, detailed, and well-designed Invoice can help establish trust with customers, which is essential for building long-term relationships.

How to write an effective Invoice in the Philippines ?

To write an effective Invoice in the Philippines, follow these steps:

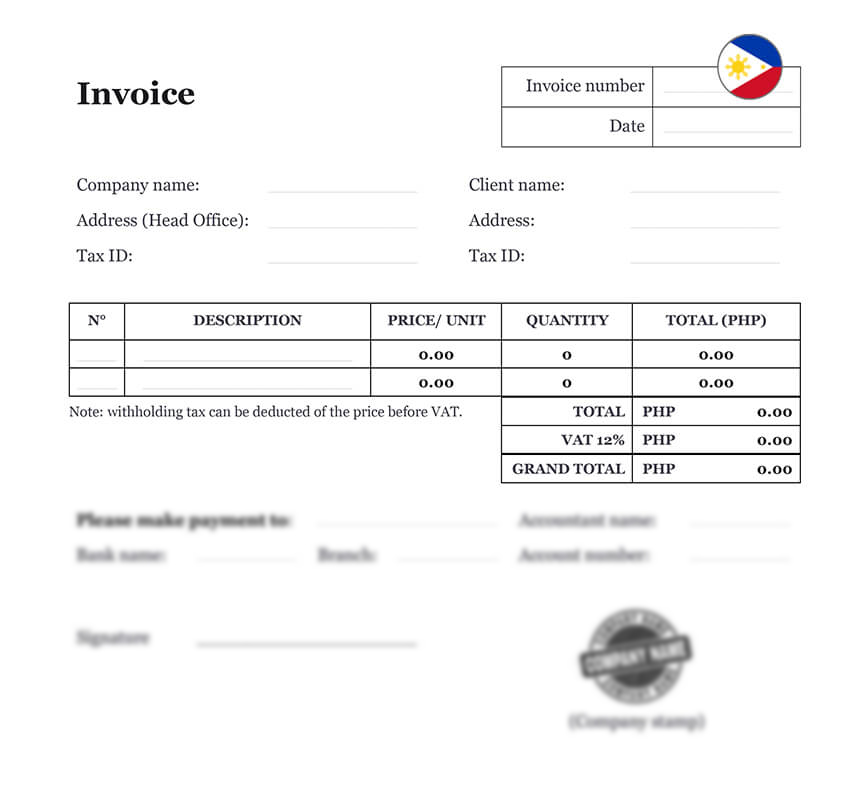

1. Include All Required Details: Make sure to include all the required details mandated by the Bureau of Internal Revenue (BIR), such as the taxpayer identification number (TIN) of both parties, the Invoice number, date of transaction, and other relevant information. This will help ensure compliance with legal requirements.

2. Use Clear and Concise Language: Use clear and concise language to describe the products or services provided. Avoid technical jargon or overly complicated language that may confuse the customer.

3. Itemize All Charges: List all charges clearly and separately in the Invoice, including the cost of each item or service provided, taxes, and any other applicable fees. This will help the customer understand what they are being charged for.

4. Include Payment Terms: Clearly outline the payment terms, including the due date, payment methods, and any late payment fees. This will help prevent payment delays and ensure timely payment.

5. Make It Easy to Read: Use a clear and readable font, and ensure that the Invoice is well-organized and easy to read. Use bullet points or tables to make the information more accessible.

6. Provide Contact Information: Include your contact information, such as your business address, phone number, and email address, so that the customer can easily get in touch with you if they have any questions or concerns.

7. Branding: Incorporate your business logo, color scheme and font styles to create a professional and recognizable brand. This can also help establish trust with customers and build brand loyalty.

By following these steps, you can write an effective Invoice in the Philippines that will help ensure compliance with legal requirements, timely payment, and clear communication with your customers.

What are the regulations regarding tax Invoices in the Philippines?

The Bureau of Internal Revenue (BIR) has specific regulations regarding tax Invoices in the Philippines. Here are some of the key regulations:

| ➤ Issuance of Invoices: Every business is required to issue Invoices for every sale, barter, exchange, or lease of goods or services. |

| ➤ Invoices should contain the following information: The taxpayer identification number (TIN) of the seller and buyer, the Invoice number, the date of the transaction, a description of the goods or services provided, the quantity, the unit price, and the total amount due. |

| ➤ Proper Invoicing Sequence: Invoices should be issued in chronological order, and each Invoice should have a unique number. The sequence of Invoice numbers should not be skipped or repeated. |

| ➤ Special Rules for Large Transactions: For transactions exceeding Php 100,000, additional information should be included, such as the name, address, and TIN of the buyer, and the gross amount and tax due for the transaction. |

| ➤ Timing of Issuing: Invoices should be issued at the time of the transaction or within 15 days after the end of the month when the transaction was made. |

| ➤ Preservation of Records: Businesses are required to keep a copy of all Invoices issued for a period of at least three years. |

| ➤ Penalties for Non-Compliance: Failure to comply with invoicing regulations may result in penalties or fines. |