What is an AGM?

An Annual General Meeting (AGM) is a mandatory meeting held by a company or organization once a year. It provides an opportunity for shareholders or members to gather and discuss important matters related to the company’s operations, financial performance, and governance. The AGM is typically held to present annual reports, elect directors, approve financial statements, and address any other significant business matters.

Why is an AGM important in the Philippines?

AGMs hold great importance in the Philippines for several reasons. Firstly, they ensure transparency and accountability within a company. By providing shareholders or members with an opportunity to participate and voice their concerns, AGMs promote good corporate governance and strengthen stakeholder engagement. AGMs also serve as a platform for companies to share key information, such as financial performance and strategic initiatives, fostering trust and confidence among stakeholders.

What are the key steps to prepare for an AGM in the Philippines?

To prepare for an AGM in the Philippines, several key steps should be followed. Firstly, the company should review its governing documents, such as the Articles of Incorporation and By-laws, to determine the specific requirements and procedures for holding an AGM. Next, the board of directors should set a date, time, and venue for the meeting, ensuring compliance with legal timelines and notification requirements.

The preparation process also involves compiling and organizing relevant documents, such as financial statements, annual reports, and proposed resolutions. The agenda should be prepared, outlining the topics to be discussed and any proposed resolutions for voting. It is essential to ensure that all necessary materials are distributed to shareholders or members within the prescribed timeframe to allow them to make informed decisions.

Additionally, logistical arrangements, such as venue booking, audio-visual equipment, and security measures, should be taken care of. Finally, a comprehensive communication plan should be implemented to notify and invite shareholders or members to the AGM, providing them with all the relevant information and documentation they need to participate effectively.

What are the legal requirements for holding an AGM in the Philippines?

In the Philippines, companies are legally required to hold an AGM within a certain timeframe, usually within four months after the end of their fiscal year. The specific legal requirements for holding an AGM can vary depending on the type of company, its structure, and the industry it operates in.

Some of the common legal requirements for an AGM include providing advance notice to shareholders or members, publishing meeting notices in newspapers or electronic platforms, ensuring a quorum is present for the meeting, and allowing for proxy voting. The Companies Act and other relevant laws and regulations govern these requirements, and companies must comply with them to hold a valid and legally recognized AGM.

It is crucial for companies to review the applicable laws, consult legal professionals if necessary, and ensure strict adherence to the legal requirements to conduct a compliant and effective AGM.

How do you set the agenda for an AGM in the Philippines?

Setting the agenda for an AGM in the Philippines involves careful consideration of the topics to be discussed and the proposed resolutions for voting. The agenda should be comprehensive, addressing all significant matters that require shareholders’ or members’ attention and decision-making.

Typically, the agenda includes items such as the approval of financial statements, election of directors, appointment of auditors, declaration of dividends, and any other matters that the company or its shareholders deem important. It is essential to include a clear and concise description of each agenda item to provide shareholders or members with a thorough understanding of the issues at hand.

The agenda should be prepared in advance and shared with shareholders or members along with the notice of the meeting. This allows them sufficient time to review the agenda and come prepared to discuss and vote on the relevant matters. The company’s governing documents, such as the Articles of Incorporation and By-laws, may provide guidance on specific agenda items that must be included or any additional requirements.

It is advisable to review previous AGM agendas, consult with key stakeholders, and seek lawyers, if needed, to ensure that the agenda is well-structured, comprehensive, and aligns with the company’s objectives and legal obligations.

How do you notify and invite shareholders to an AGM in the Philippines?

Notifying and inviting shareholders to an AGM in the Philippines requires a systematic and well-executed communication plan. The objective is to ensure that all shareholders receive the necessary information about the meeting, including the date, time, venue, agenda, and relevant documentation.

Firstly, companies should review their governing documents to determine the specific notification requirements, such as the minimum notice period and the modes of communication allowed (e.g., mail, email, publication). Compliance with these requirements is essential to ensure that the meeting is legally valid and that shareholders have sufficient time to prepare for their participation.

Companies should maintain an updated shareholders’ register, which includes the contact details of all shareholders. This register serves as a basis for sending out the meeting notices. The notices should be prepared in accordance with the prescribed format and contain all the relevant information, including instructions on how to attend the meeting, submit proxies, and obtain additional documentation.

Companies may use various communication channels, such as postal mail, email, or secure online platforms, to send the notices and relevant materials to shareholders. It is essential to maintain a record of the sent notices and any returned or undeliverable communications.

Additionally, companies can leverage their website, bulletin boards, or other public platforms to publish meeting notices and ensure wider dissemination of information. This helps reach shareholders who may not have received the direct communication and promotes transparency in the process.

What are the post-AGM requirements and compliance obligations in the Philippines?

After conducting an AGM in the Philippines, companies have certain post-meeting requirements and compliance obligations to fulfill. These obligations are essential for maintaining transparency, documenting decisions, and adhering to legal regulations. Some key post-AGM requirements include:

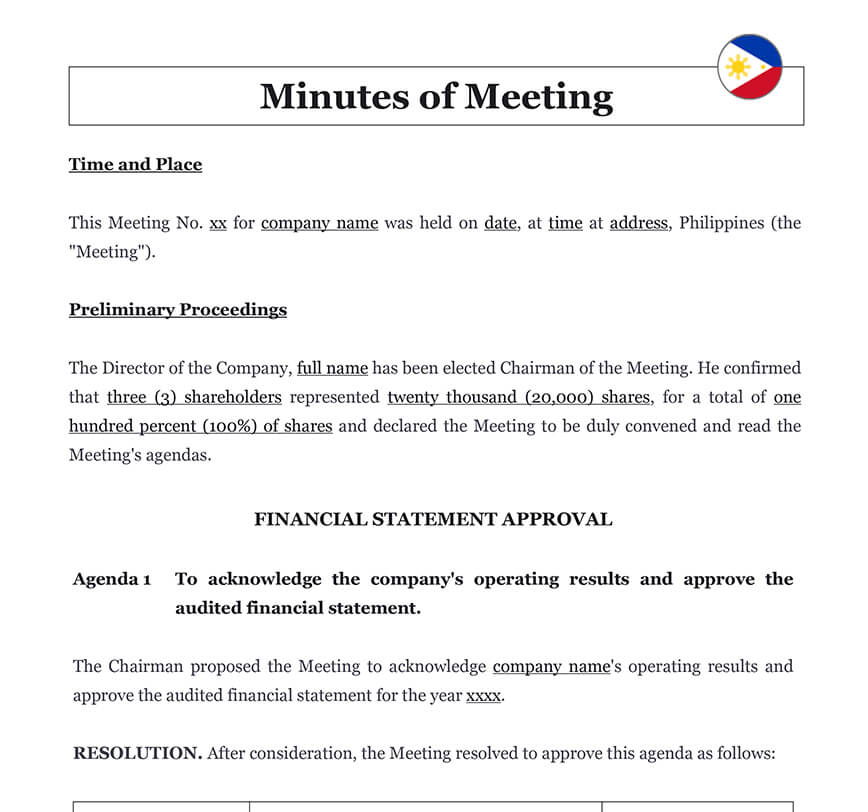

1. Minutes of the Meeting

The minutes of the meeting should be prepared and documented. The minutes should accurately record the discussions, resolutions, and any voting results during the meeting. These minutes serve as an official record of the proceedings and may be required for future reference or regulatory compliance.

2. Filing Requirements

Companies are often required to file certain documents with relevant government agencies, such as the Securities and Exchange Commission (SEC) or the Department of Trade and Industry (DTI). These filings may include the annual financial statements, resolutions passed during the AGM, and other mandated reports. It is crucial to adhere to the prescribed timelines and procedures for these filings to avoid penalties or non-compliance issues.

3. Shareholder Communications

Companies should communicate the outcomes of the AGM to shareholders who were unable to attend the meeting. This can be done through the distribution of post-AGM reports or updates, which summarize the key discussions, decisions, and resolutions made during the AGM. Providing such information helps maintain transparency and keeps shareholders informed about the company’s progress and future plans.

4. Implementation of Resolutions

Any resolutions passed during the AGM should be implemented as required. For example, if the AGM approved the appointment of new directors or auditors, steps should be taken to fulfill these appointments and update the necessary records and authorities.

5. Compliance with Other Obligations

Companies must also ensure compliance with other ongoing obligations, such as tax filings, corporate governance requirements, and any industry-specific regulations. These obligations may vary based on the company’s structure, activities, and industry, and it is important to stay updated on the applicable legal and regulatory framework.

By fulfilling these post-AGM requirements and compliance obligations, companies demonstrate their commitment to good governance, maintain transparency, and uphold their legal responsibilities in the Philippines.